Investing in the stock market can feel like playing a game without the rules. Are you tired of information overload, emotional decisions, and the endless “what if” of missing the next big opportunity?

Sterling Stock Picker is the 4.8-star-rated AI platform that promises to fix this. It’s a “personal financial coach” that analyzes 60,000+ stocks and gives you data-backed recommendations. In this in-depth Sterling Stock Picker review, we’re testing this 5-star AppSumo lifetime deal.

My Quick Take for the Savvy Investor

I think you’re here because you’re a smart solopreneur, freelancer, or even a seasoned investor. You’re looking for an “AI-edge” to save you time and help you invest smarter, without paying $200+/year for a premium subscription. Here’s my direct take.

- What is it? Sterling Stock Picker is an AI-powered, “all-in-one” investment platform. It combines AI-driven stock recommendations, a powerful portfolio tracker, advanced stock screeners (with “Stock Rockets” for high-growth), and a personal AI financial coach called “Finley.”

- Why is it a Game-Changer? It replaces your need for expensive subscriptions. It gives you the “80/20” data of a $2,000/year Bloomberg Terminal (like real-time data, analyst ratings, and sentiment) in a simple, “grandma-friendly” dashboard.

- Who is it for? New investors who need guidance, busy professionals who need to save time on research, and experienced investors who want an AI “edge” to find undervalued stocks.

- The AppSumo Deal: This is a $69 one-time payment for lifetime access to their “Paid Plan,” which normally costs $243 per year.

- My Verdict: With a 4.8-star rating from 31+ reviews and a very active founder (Jaden Sterling) shipping new features, this is a 5-star, “blue-chip” deal. The value is astronomical. It’s a “no-brainer” investment for anyone serious about building wealth.

Check the Sterling Stock Picker Lifetime Deal Now!

Now, let’s talk about the real problem. As someone who actively invests to grow my business, I’m always on the hunt for tools that are affordable, efficient, and easy to use. But the world of “finance tools” is a nightmare.

Investing in the stock market can feel overwhelming. Common frustrations include:

- Information Overload: You’re drowning in endless charts, complex earnings reports, and conflicting analyst opinions.

- Emotional Decisions: Fear of missing out (FOMO) and panic-selling often lead to buying high and selling low.

- Time Constraints: Researching one stock properly can take hours. Researching a full portfolio of 20 stocks is a full-time job.

You know you should be investing, but you’re stuck. This is the exact problem I was facing before I found Sterling Stock Picker. It’s an AI-driven platform designed to simplify this entire process by providing data-backed recommendations, portfolio tracking, and real-time insights, all for a one-time price.

Table of Contents

ToggleWhat is Sterling Stock Picker?

The best way to describe Sterling Stock Picker is as your personal “AI co-pilot” for investing. It’s not a “robo-advisor” that invests for you. It’s a “decision-support” platform.

It’s a single, powerful dashboard that analyzes a massive database of 60,000+ stocks and cryptocurrencies. It uses its AI (named “Finley”) to analyze:

- Fundamentals: P/E ratios, revenue growth, and debt levels.

- Technicals: Moving averages, RSI, and other chart indicators.

- Market Sentiment: News trends and social media analysis.

It then takes all this complex data and distills it into simple, actionable insights, like a “5-Star Northstar Rating” or a “Stock Rocket” (high-growth) alert.

It’s built for all investor levels:

- New Investors: It provides “done-for-you” portfolio builders based on your risk tolerance.

- Experienced Investors: It provides a “pro-level” stock screener and AI analysis to find undervalued opportunities you might have missed.

- Busy Professionals: It saves you 5-10 hours of research per week.

Why You Need More Than Just Your “Broker’s” Free Tools

If you use a free tool like Robinhood or a standard broker, you’re getting a “dumb” tool. It’s a platform to place a trade, not a platform to do research.

The “free” tools are a “black box.”

- They don’t have an AI coach like “Finley” to answer your questions.

- They don’t have powerful screeners for “50%+ earnings growth.”

- They don’t have a community forum or weekly livestreams from an expert.

- They don’t send you proactive “Buy/Sell” alerts.

This is the market gap that Sterling Stock Picker fills. It’s the “pro-level research brain” that your “free” brokerage app is missing. It’s the tool that helps you decide what to buy, when to buy it, and when to sell it.

Why This 4.8-Star Deal is a 5-Star Champion

When you’re buying a finance tool, trust (E-E-A-T) is the only thing that matters. This is where Sterling Stock Picker truly shines.

It has a massive 4.8-star rating from 31+ reviews, and the reviews are glowing. But the real trust signal is the founder, Jaden Sterling.

- He’s Active: He is all over the AppSumo page, personally responding to reviews and posting major updates (like the Feb 5, 2025, and Jan 27, 2025, updates).

- He’s Improving the Tool: The new updates are not “fluff.” He’s adding new global stock exchanges (India, Australia, Hong Kong), 28 new currencies, and new AI features.

- He’s Been Doing This for Years: One 5-star user (“9jaoncloud”) says: “I have also watched videos of the tool for 5 years, and I will say it has changed a lot with lots of improvements.”

This is the ultimate “blue-chip” deal. You are not buying a “v1” gamble. You are buying a mature, proven, 5-star platform from a dedicated founder who has been improving it for at least 5 years. This is a 100% safe, long-term investment.

A Look Inside Sterling Stock Picker: Key Features & Benefits

This lifetime package is packed with features that are normally locked behind $200/year subscriptions.

“Finley AI”: Your Personal Financial Coach

- What it is: This is your personal, 24/7 AI financial assistant. You can ask it anything, from “Explain P/E ratio like I’m 5” to “Analyze my current portfolio and suggest adjustments for my ‘Growth’ risk level.”

- Why it matters: This is like having an “on-demand” financial expert. It “empowers you to make well-informed investment decisions” by giving you “detailed, nuanced” answers. It’s a massive confidence-booster for non-experts.

The “Northstar” 5-Star Ranking System

- What it is: This is the core of the AI. The AI analyzes every stock based on fundamentals, financials, and technicals, and gives it a simple “1-to-5-Star” rating.

- Why it matters: It’s a “cheat sheet.” It simplifies 100 hours of research into a single, trustworthy number. You can instantly see the “Top Rated Stocks” that the AI has identified as 5-star “buys.”

“Stock Rockets” & “Success Recipes”

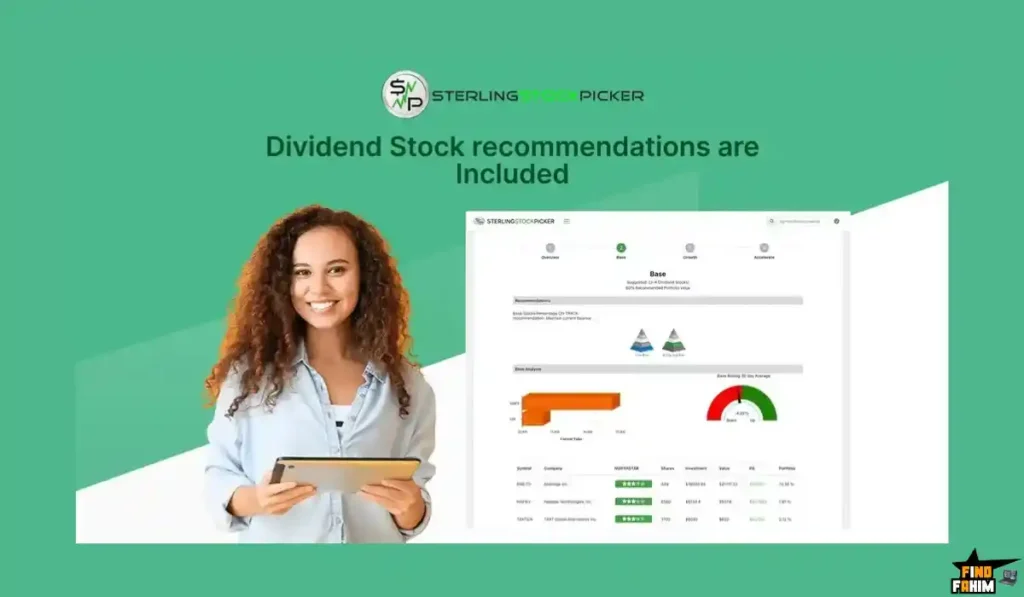

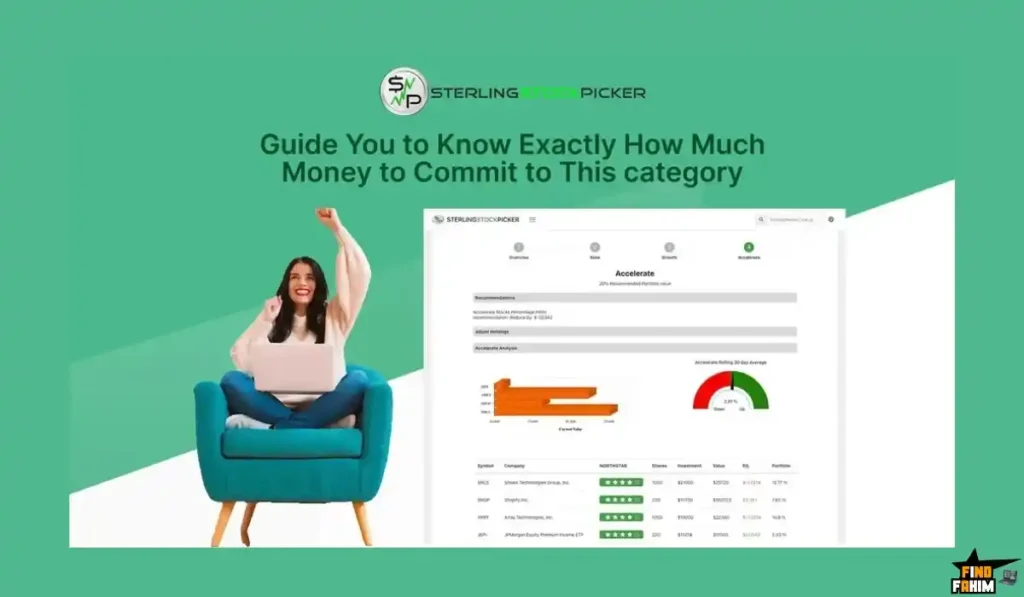

- What it is: These are high-power, pre-built screeners. “Stock Rockets” automatically finds stocks with 50%+ quarterly revenue growth and a 5-star rating. “Success Recipes” are pre-built searches for strategies like “Dividend Income” or “Value Opportunities.”

- Why it matters: This is the ultimate “time-saver.” You don’t have to build your own complex screeners. You can just click one button and instantly get a list of high-potential “momentum” stocks.

Advanced Stock Screener

- What it is: This is the “pro” tool. You can build your own search from scratch, filtering all 60,000+ stocks and cryptos by sector, industry, market cap, dividend yield, risk level, and even “personal values” (like “green energy”).

- Why it matters: This is the true “Ahrefs-lite” for stocks. It lets you take control and hunt for the “undervalued” gems that no one else has found yet.

Portfolio Tracking & “Done-For-You” Builder

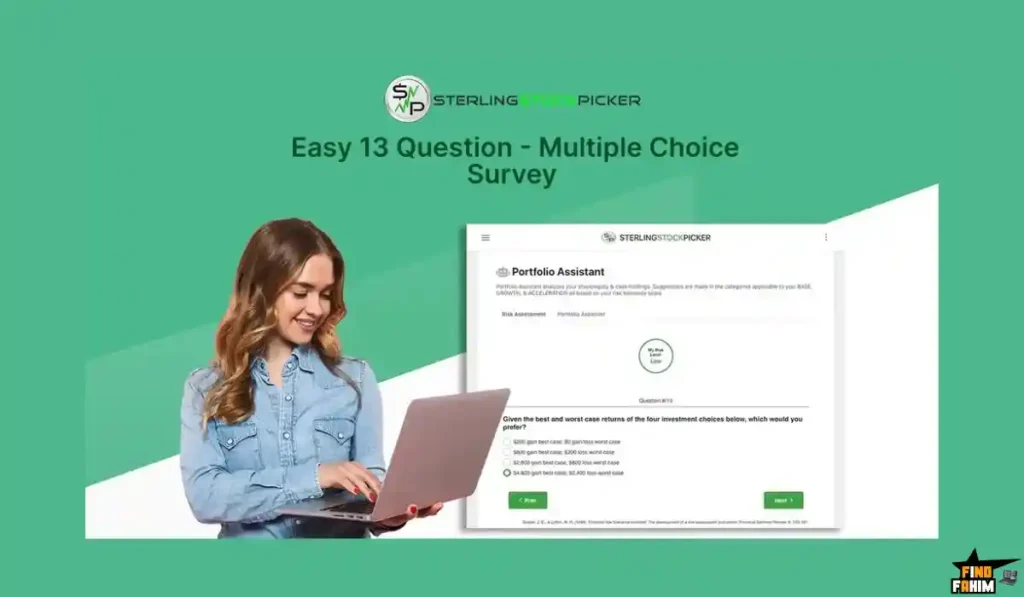

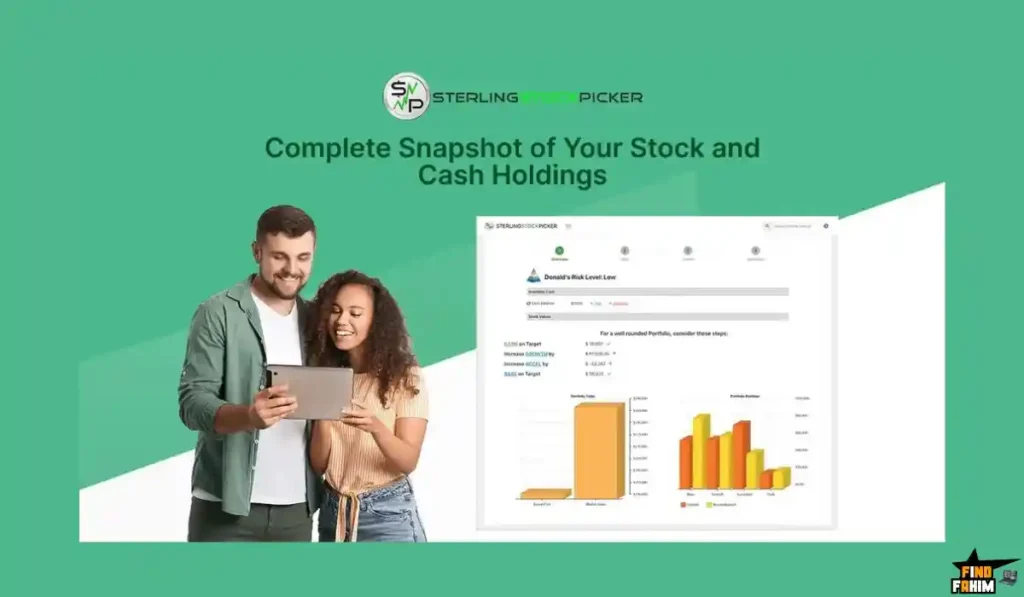

- What it is: A single, clean dashboard to track all your stock and cash holdings in one place. It also has a “Done-For-You Portfolio Builder” that suggests a full portfolio for you based on your 5-minute risk-tolerance survey.

- Why it matters: It replaces your “messy spreadsheets.” It gives you a clean overview, tracks your performance against benchmarks (like the S&P 500), and sends you rebalancing alerts.

Community: Weekly Livestreams & Stock Forum

- What it is: Your lifetime deal includes access to a weekly live stream with the founder, Jaden Sterling, and a private stock forum where you can chat with other investors.

- Why it matters: This is an insane E-E-A-T value. You’re not just buying software; you’re buying access to a community and an expert. This is a $1,000/year “mastermind” feature included for free.

The Standout Feature: It’s an “Expert System,” Not a “Black Box”

The single standout feature of Sterling Stock Picker is that it’s an “expert system” that teaches you, not a “black box” that tells you what to do.

A “robo-advisor” (like Betterment) just takes your money and invests it. You learn nothing.

Sterling Stock Picker is designed to make you a smarter investor.

- Finley AI gives you “verbose explanations” to help you “understand complex financial jargon.”

- The “Northstar Rating” shows you its work.

- The Weekly Livestreams give you direct access to the founder’s brain.

This is the ultimate “teach a man to fish” platform. It’s an “AI co-pilot” that sits next to you, giving you the data, insights, and confidence to make your own smart decisions.

How Does Sterling Stock Picker Work?

The platform is built on a simple, 3-step “investor journey.”

- Discover Your Risk Tolerance: You take a simple, 5-minute, 13-question survey. This is critical. It determines if you are “Conservative,” “Growth,” or “Accelerate.”

- Search for Stocks: You use the Stock Screener or “Success Recipes” to find stocks that match your risk level.

- Build Your Portfolio: You use the “Done-For-You Portfolio Builder” (which is now aligned with your risk score) or add stocks manually. The platform then tracks your portfolio 24/7.

The Sterling Stock Picker AppSumo Deal Details

This is a non-stackable, single-plan deal. The choice is simple, and the value is astronomical.

| Feature | Free Plan | The AppSumo LTD (Paid Plan) | Official Subscription (Paid Plan) |

| One-Time Price | $0 | $69 | $243 / YEAR |

| Stock Analysis (60k+ Stocks) | ❌ No | ✅ Yes | ✅ Yes |

| Crypto Analysis | ❌ No | ✅ Yes | ✅ Yes |

| Finley AI Coach | ❌ No | ✅ Yes | ✅ Yes |

| Stock Rockets | ❌ No | ✅ Yes | ✅ Yes |

| Weekly Livestreams | ❌ No | ✅ Yes | ✅ Yes |

| Community Forum | ❌ No | ✅ Yes | ✅ Yes |

| See the Sterling Stock Picker Appsumo Deal Plan! | |||

Which Plan Should You Get? My Recommendation

This is the easiest recommendation I’ve ever made.

- The “Official Subscription” ($243/year): This is a high-value tool that is worth its $20/month price tag.

- The “AppSumo Lifetime Deal” ($69): This is the same “Paid Plan” for a $69 one-time payment.

You pay $69 once. You get a tool that costs $243 every single year.

This cost-friendly deal pays for itself in just 3.5 months. After that, you are saving $243 every year, forever. It is an absolute “no-brainer” for anyone serious about investing.

Pros & Cons of This Lifetime Package

With a 4.8-star rating from 31+ reviews, this is a 5-star “blue-chip” deal. Here’s my honest, balanced look.

The Pros

- Astronomical ROI: This is the #1 pro. Paying $69 once to replace a $243/year subscription is one of the best “math” deals on AppSumo.

- Massive Trust (4.8-Stars): This is a mature, 5-star platform. The 31+ reviews are glowing (“Great financial tool,” “A much-needed tool”).

- Active, Proven Founder (E-E-A-T): The founder (Jaden Sterling) has been working on this for 5+ years and is still shipping massive, high-value updates (new exchanges, new features). This is a 100% safe, “future-proof” investment.

- It’s an “AI Coach,” Not a “Black Box”: The “Finley AI” and “Stock Forum” features are incredible. You’re not just buying data; you’re buying guidance and a community.

- Mobile Apps are Here: The Feb 2025 update confirms the iOS and Android apps are live, fixing a major “con” from older reviews.

The Cons

- It’s a Limited-Time Deal: This is my only “soft con.” A 4.8-star tool that replaces a $243/year subscription will not be on a lifetime deal forever. The biggest risk is waiting and being forced to pay the full monthly price.

- The “Honest Expert” Nuance: As a couple of 5-star reviewers (“CinemagicMedia”) honestly point out, the UI can be “sluggish and unresponsive at times” and the “dark theme needs work.” This is not a “con”; it’s a “v1” quirk. The founder has already responded and said they are “actively working on performance optimizations.” This is a minor, temporary issue on a high-value platform.

Best Use Cases for Sterling Stock Picker

Here are just a few real-world scenarios where this tool is a perfect fit:

- For New Investors: You’re terrified of the stock market. You take the 5-minute Risk Survey, get your “Growth” profile, and use the “Done-For-You Portfolio Builder” to get a safe, balanced, and data-driven list of stocks to start with.

- For Busy Professionals: You don’t have 10 hours a week to read SEC filings. You log in, check the “Stock Rockets” list, and instantly see the top 5 high-growth stocks the AI has flagged for you.

- For “Dividend” Investors: You’re a “Conservative” investor. You use the Stock Screener, filter by “Dividend Yield > 4%,” and get a clean list of reliable, income-generating stocks.

- For Crypto Investors: You can use the same dashboard to track your Bitcoin and Ethereum holdings and see the technical analysis for them right next to your “boring” stocks.

For other amazing tools to build your business, don’t forget to check out my hand-picked list of the best AppSumo lifetime deals!

Get Your Sterling Stock Picker Lifetime Deal Now!

Sterling Stock Picker vs The Competition

This is the most important part of the review. Sterling Stock Picker is a $69 lifetime deal entering a market dominated by $200/year “legacy” giants.

Its strategy is not to have more features than these 30-year-old companies. Its strategy is to be the Ultimate 80/20 “AI Coach.” It leverages new AI (like “Finley”) to give you 80% of actionable insights you actually need, for 1% of the long-term price.

Sterling Stock Picker vs Seeking Alpha Premium

This is the “AI Coach vs. The Expert Library” showdown. Seeking Alpha is a massive, data-heavy platform beloved by “pro-level” investors.

Where Seeking Alpha Takes the Lead

Seeking Alpha’s power comes from its community. It has over 7,000+ contributors who write 10,000+ investment articles per month. Its “Premium” plan (at $299/year) gives you access to this massive “crowd-sourced” research library. It also has a powerful “Quant Rating” system and in-depth “Dividend Grades” that are fantastic for “hands-on” investors who love to do deep research.

Why Sterling Stock Picker is the Smarter “Action” Tool

Seeking Alpha is a research library; you still have to read 10 articles to form an opinion. Sterling Stock Picker is an AI coach; it does the research for you and gives you a single, simple 5-star “Northstar Rating.”

While Seeking Alpha is for “hands-on” investors, SSP is for busy investors. Its “Finley AI” and “Stock Rockets” features are designed to save you time and give you answers, not just more reading. For a one-time $69 price, it’s the perfect “80/20” alternative for the person who wants the answer without the homework.

Sterling Stock Picker vs The Motley Fool Stock Advisor

This is the “AI Coach vs. The ‘Black Box” showdown. The Motley Fool’s Stock Advisor is one of the most famous and heavily advertised “stock picking services” in the world.

Where The Motley Fool Takes the Lead

The Motley Fool’s strength is its simplicity. You pay them $199/year, and they simply give you two stock picks per month. It’s a “done-for-you” service for people who have zero time or interest in doing any research. They also provide “Model Portfolios” to help you build a list of “starter stocks.”

Why Sterling Stock Picker is a Better “Teaching” Tool

The Motley Fool is a “black box.” They tell you what to buy, but they don’t really show you how to find the next one. Sterling Stock Picker is the opposite. It’s a “white box.” It teaches you how to invest.

- SSP gives you the Stock Screener so you can find your own picks.

- SSP gives you Finley AI to answer your own questions.

- SSP gives you the Weekly Livestreams and Stock Forum to learn from a community.

The Motley Fool gives you a fish. Sterling Stock Picker teaches you how to fish, all for a $69 one-time payment.

Sterling Stock Picker vs Morningstar Premium

Morningstar is (or was) the “gold standard” for traditional, fundamental investment research and portfolio management.

Where Morningstar Takes the Lead

Morningstar built its 30-year reputation on its “Analyst Ratings” and its powerful “X-Ray” tool, which could “look inside” your mutual funds. It was the trusted “boomer-era” tool for long-term, fundamental investors.

Why Sterling Stock Picker is the “Future-Proof” Choice

This is a massive win for Sterling Stock Picker. As of 2025, Morningstar is discontinuing its “Premium” membership and retiring its most beloved tools, like the “Portfolio Manager” and “Stock Analyst Research.” They are abandoning the retail investor.

Sterling Stock Picker is the perfect modern alternative. It has the AI-powered Portfolio Assistant (that Morningstar is retiring), it has the AI “Finley” analyst (to replace their human ones), and it’s on a $69 lifetime deal just as Morningstar is exiting the game. SSP is the new, “next-generation” tool that is replacing the old, outdated giants.

Sterling Stock Picker vs Tickeron

Tickeron is another popular AppSumo lifetime deal and a direct, AI-powered competitor. It’s also a powerful platform for finding stock picks.

Where Tickeron Takes the Lead

Tickeron’s strength is its “AI Robots.” It’s a platform built for active traders. You can follow different “bots” (like “AI Robots for Swing Traders”) that generate buy and sell signals based on technical patterns. It’s a very “technical analysis” focused tool.

Why Sterling Stock Picker is the Better “All-in-One”

Tickeron is a “trading” tool. Sterling Stock Picker is an investing tool. SSP is built on a “hybrid” model of both fundamentals (like “Stock Rockets” 50%+ revenue growth) and technicals. More importantly, SSP includes the “community” features that Tickeron lacks: the Weekly Livestreams with the founder and the Community Stock Forum. SSP is not just software; it’s an educational ecosystem.

All Competitors Table

| Tool | Key Strength | Pricing Model | Best For |

| Sterling Stock Picker | AI Coach (Finley) & Community | Lifetime Deal ($69) | New & Busy Investors |

| Seeking Alpha Premium | Expert “Crowd-Sourced” Research | $299 / year (Subscription) | “Hands-On” Pro Investors |

| Motley Fool Stock Advisor | “Done-For-You” Stock Picks | $199 / year (Subscription) | Beginners (No Time/Interest) |

| Morningstar Premium | (Being Discontinued) | N/A (Discontinued) | (The “Old Guard”) |

| Tickeron | AI “Trading Bots” | Lifetime Deal (Varies) | Active / Technical Traders |

Is This a Smart Business Investment?

Let’s do the simple, powerful math.

- A Seeking Alpha Premium subscription costs $299 per year.

- A Motley Fool Stock Advisor subscription costs $199 per year.

- The official Sterling Stock Picker subscription costs $243 per year.

You are looking at an annual, recurring cost of $200 – $300 just for one of these “pro” tools.

The Sterling Stock Picker AppSumo lifetime deal gives you the same “Paid Plan” (the $243/year one) for a one-time payment of $69.

This cost-friendly deal pays for itself in less than 4 months.

After that, you are saving $243 every single year, forever. This is not just a “good deal”; it’s an investment in your own financial education and a permanent, cost-free asset in your wealth-building toolkit. The ROI is astronomical.

How to Redeem the Sterling Stock Picker Deal

- Go to the official Sterling Stock Picker AppSumo deal page.

- Click “Buy Now” to purchase the $69 Lifetime Plan. (It is not stackable.)

- AppSumo will send you a unique code. You have 60 days to redeem it on the Sterling Stock Picker website to activate your lifetime account.

- CRITICAL: The deal terms state this is “For NEW customers only.” If you have an existing account, you must use a new email address.

Final Verdict: Is This Cost-Friendly Deal Worth It?

After this deep dive into the Sterling Stock Picker reviews and its powerful, AI-driven platform, my final verdict is an absolute, 5-star YES.

This is a “blue-chip” AppSumo champion. With a 4.8-star rating, this is not a “v1” gamble. It’s a mature, 5-star platform from a dedicated founder (Jaden Sterling) who has been improving it for over 5 years. The recent 2025 updates (new exchanges, new AI features) are a massive “trust signal” that this deal will be supported for the long haul.

It’s the perfect “80/20” alternative to the expensive subscription giants. It’s not a “black box” (like Motley Fool) and it’s not a “data ocean” (like Seeking Alpha). It’s an “AI Coach” (Finley) that gives you the data, the community, and the confidence to make your own smart decisions.

For a $69 one-time payment, you are getting a $243/year tool. The value is undeniable. This is a must-have for any solopreneur or professional who is serious about investing.

Grab the Sterling Stock Picker Lifetime Deal Before It’s Gone!

Note: A 4.8-star, mature financial tool that replaces a $243/year subscription is extremely rare. This is not a tool, it’s an asset. The $69 price is an unbelievable value that will not last forever.

About the Author: Why I Care About This So Much

I’m a solopreneur, and for years, I was terrified of “investing.” It felt like a “rich-person’s game” that was too complex and too expensive to enter. I was stuck in the “subscription trap,” paying for tools I didn’t understand.

A tool like Sterling Stock Picker gets me genuinely excited because it solves this. It’s an “empowerment” tool. It doesn’t just “give you picks”; it teaches you why a stock is a 5-star “buy.” It’s an AI coach, a community, and a data platform all in one.

This $69 lifetime deal is the “key” that unlocks a “pro-level” investing world for the rest of us. It’s a tool that helps you build real wealth, and I am incredibly passionate about that.

FAQ: Your Sterling Stock Picker Questions, Answered

What is Sterling Stock Picker in simple terms?

Sterling Stock Picker is an AI-powered investment assistant that analyzes over 60,000 stocks and cryptocurrencies. It gives each one a simple 5-star rating so investors can instantly identify the best opportunities without hours of research.

Is Sterling Stock Picker a robo-advisor?

No. Sterling Stock Picker is not a robo-advisor and does not invest your money. It’s a decision-support tool that provides AI-driven insights and data so you can make smarter investment decisions while staying in full control of your trades.

Does Sterling Stock Picker offer a lifetime deal?

Yes. The AppSumo deal gives lifetime access for a one-time payment of $69, compared to the regular annual price of $243 — making it one of the most affordable long-term investment tools available.

What is Finley AI inside Sterling Stock Picker?

Finley AI is your built-in AI financial assistant. It answers complex questions about your portfolio, market trends, or individual stocks, giving clear, data-backed insights instantly.

What are Stock Rockets in Sterling Stock Picker?

Stock Rockets are pre-built pro-level stock screeners highlighting high-growth opportunities — typically stocks with 50%+ quarterly revenue growth and a 5-star Northstar Rating.

Can I get a refund if I don’t like Sterling Stock Picker?

Yes, absolutely. You are covered by AppSumo’s 60-day money-back guarantee, giving you two full months to try it risk-free.

Is Sterling Stock Picker for new users only?

Yes. The lifetime deal is only available for new users. You’ll need to use a new email address to redeem your access.

Does Sterling Stock Picker have a mobile app?

Yes. Sterling Stock Picker now offers iOS and Android apps, released in February 2025, allowing you to analyze stocks, track ratings, and access Finley AI on the go.

Is Sterling Stock Picker a trusted, long-term company?

Yes. With a 4.8-star average rating and over 5 years of consistent updates, it’s considered a blue-chip AI investing tool with an active founder and engaged user base.

How is Sterling Stock Picker better than Seeking Alpha?

Seeking Alpha is a research library filled with thousands of articles, while Sterling Stock Picker is an AI-driven advisor that gives you actionable insights and simplified ratings — no deep reading required.

How does Sterling Stock Picker compare to The Motley Fool?

The Motley Fool gives 2 stock picks per month, but Sterling Stock Picker teaches you how to find your own picks through AI screeners, Finley insights, and transparent data.

What global markets does Sterling Stock Picker cover?

Sterling Stock Picker now supports major global exchanges including the U.S., India (NSE & BSE), Australia (ASX), and Hong Kong (HKSE), making it a global investment tool.

What is the Sterling Stock Picker community forum?

It’s an exclusive mastermind community for users to share market insights, stock ideas, and portfolio strategies — included for free with the lifetime deal.

Why are AI tools becoming popular in investing?

AI tools like Sterling Stock Picker simplify complex financial data, helping both beginners and pros identify trends, reduce risk, and make faster, smarter trading decisions.

Is the $69 Sterling Stock Picker lifetime deal really worth it?

Yes. It replaces a $243/year plan with a one-time $69 payment, saving you hundreds annually while giving lifetime access to premium AI investing tools and updates.

Hi, I’m Fahim — a SaaS tools reviewer and digital marketing expert with hands-on experience helping businesses grow using the right software. I research, test, and personally use a wide range of AI, business, productivity, marketing, and email tools for my agency, clients, and projects. I create honest, in-depth reviews and guides to help entrepreneurs, freelancers, startups, and digital agencies choose the best tools to save time, boost results, and scale smarter. If I recommend it, I’ve used it — and I only share what truly works.