Timing the crypto market usually feels like throwing darts in the dark.

One minute, Bitcoin is soaring, and you feel like a genius. The next minute, a random regulatory rumor crashes the market by 15%, and your portfolio is in the red. You panic sell, only to watch it bounce back an hour later.

This cycle of “Emotional Trading” is why 90% of retail investors lose money.

While you are staring at 1-minute candles on TradingView, institutional investors are using Quantitative Models and AI Sentiment Analysis to make cold, calculated decisions. They don’t guess; they calculate probability.

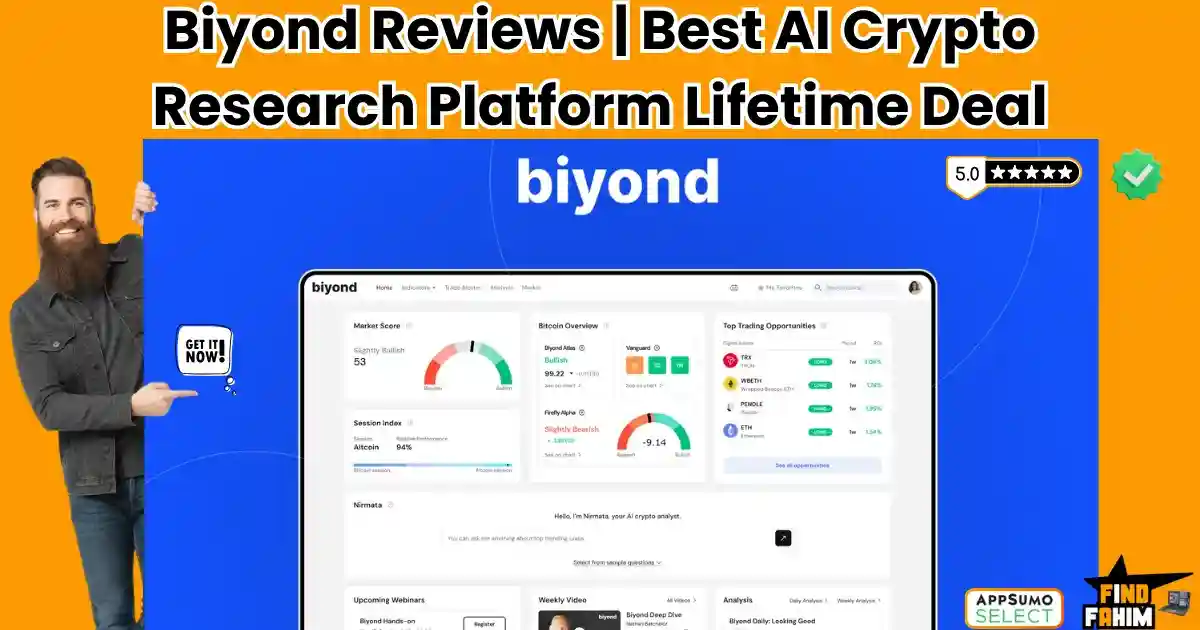

Biyond is your chance to level the playing field.

It is an AI-powered crypto intelligence platform that acts as your personal “Quantitative Analyst.” It combines hard data (price action, volume) with soft data (market sentiment, news) to tell you exactly when the market is overheated and when it is ripe for entry.

But is a $59 tool really smart enough to beat the market? Or is it just another “Magic Signal” scam wrapped in AI buzzwords?

In this in-depth Biyond review, I am going to test the accuracy of its “Nirmata” AI, analyze the quality of its trading signals, and determine if this lifetime deal is the discipline tool your portfolio needs.

Note: This article contains affiliate links. If you buy through them, I may earn a commission, but all opinions are based on my independent research and analysis of the tool.

My Quick Take (TL;DR)

If you are in a rush and just want to know if you should buy this code, here is my honest summary.

- What is it? An AI-Driven Investment Research Platform. It provides buy/sell signals, market sentiment analysis, and a ChatGPT-style AI analyst dedicated to crypto.

- Why is it Special? “Nirmata” AI. Unlike generic bots, Biyond’s AI is trained on financial data. It can explain why a coin is moving, not just show you a chart.

- Who is it for? Crypto Traders, “Hodlers,” and Solopreneurs who want to manage their portfolio with logic rather than emotion.

- The Deal: Lifetime access starting at $59.

- My Verdict: Tier 2 ($269) is the real deal. Tier 1 is too limited (only the top 5 coins). If you are serious about altcoins, you need Tier 2. It is a fantastic “Second Opinion” tool that validates your trades before you pull the trigger.

Get the Biyond Lifetime Deal on AppSumo

Table of Contents

ToggleWhat is Biyond?

Biyond is not a “Trading Bot.” It will not connect to your Binance account and execute trades for you (copy trading is currently disabled for regulatory reasons).

Instead, Biyond is a GPS for the Market.

Imagine you are driving a car (trading).

- TradingView is your windshield—it shows you what is right in front of you.

- Twitter/X is the noisy passenger screaming bad directions.

- Biyond is the navigation system. It looks at the traffic ahead (on-chain data), the weather (market sentiment), and the best route (quantitative strategy).

It was founded in 2022 by Burkan Beyli in the US, with a mission to bring “Hedge Fund” strategies to the retail guy. It uses a proprietary Quantitative Framework—math-based models that identify trends, support/resistance, and momentum—to give you clear, actionable signals on over 150 cryptocurrencies.

Quick Look: What’s Inside the Deal?

I know you want to see the value instantly. Here is how Biyond stacks up against the expensive monthly tools you might be subscribing to right now.

| Feature | Replaces… | The “Killer” Value | Normal Cost | Deal Status |

| AI Crypto Analyst | TokenMetrics | “Nirmata” answers specific crypto Qs | ~$100/mo | ✅ Included |

| Trading Signals | Paid Telegram Groups | Data-backed Entry/Exit points | ~$50/mo | ✅ Included |

| Sentiment Analysis | Santiment / LunarCrush | Real-time “Fear & Greed” tracking | ~$49/mo | ✅ Included |

| Portfolio Insights | CoinStats Pro | Risk management & Asset allocation | ~$20/mo | ✅ Included |

| Market Education | Paid Courses | Weekly expert-led webinars | ~$500 (One-time) | ✅ Included |

| Altcoin Coverage | Messari | Deep dive data on 150+ coins | ~$300/mo | ✅ Tier 2 |

Why You Need More Than Just “TradingView”

You might be thinking, “Fahim, I have TradingView and some free indicators. Why do I need Biyond?”

You need it because Charts are Reactive; Data is Predictive.

The “Lagging Indicator” Problem

Most free indicators (RSI, MACD) on TradingView are “lagging.” They tell you what already happened. By the time the MACD crosses over, the big move might be over. Biyond’s AI uses Sentiment Analysis (scanning news, social media, and volatility) to gauge the “mood” of the market before the price candle even prints.

The “Analysis Paralysis” Problem

On TradingView, you can draw 50 lines and convince yourself of anything. “Is this a Bull Flag or a Bear Trap?” Biyond removes the bias. It gives you a cold, hard Quantitative Score. It doesn’t care if you “like” the coin; it only cares about the math.

Why “AI-Augmented Trading” is Trending in 2026

I noticed this deal trending (33+ reviews, 4.7 stars) because the crypto market has matured. The days of “YOLOing” into a coin because a cartoon dog tweeted about it are fading.

In 2021, everyone was a genius in a bull market.

In 2026, the market is PVP (Player vs Player). You are trading against high-frequency algorithms and institutional AI.

- The Trend: “Cyborg Trading.” The best traders aren’t purely human or purely bots. They are humans enhanced by AI.

- The Demand: Retail traders want Institutional Tools. They want the same “Bloomberg Terminal” power that the big banks have, but simplified for a $50k portfolio.

- The Shift: Tools like Biyond are democratizing Quantitative Finance. They are taking complex Python scripts and Excel models used by hedge funds and wrapping them in a simple, user-friendly UI.

A Look Inside Biyond: Key Features & Benefits

I dove into the Biyond dashboard to see if the “Institutional” claims held up. Here is the deep breakdown.

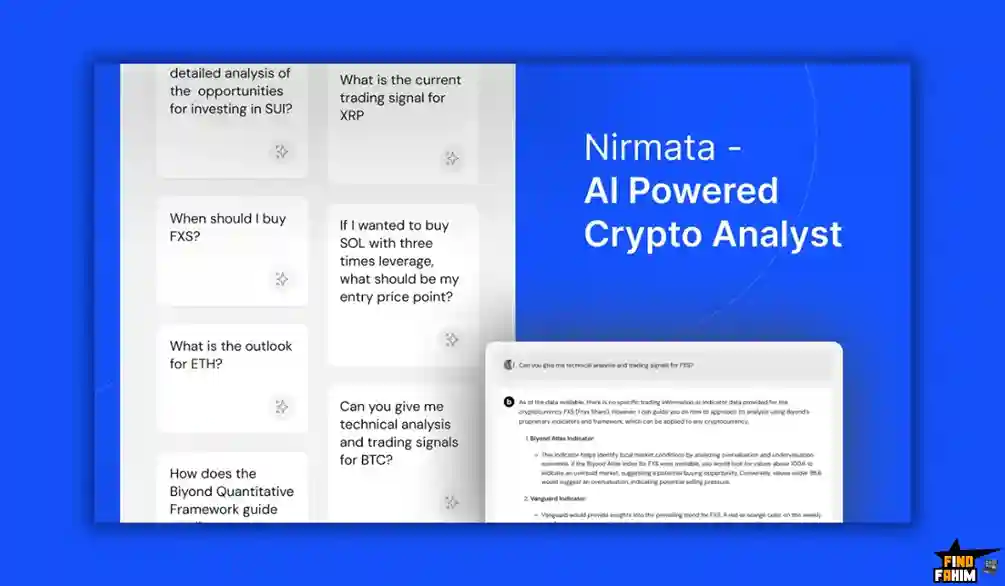

1. Nirmata: The AI Crypto Analyst

The Benefit: Having a Wall Street analyst in your pocket 24/7.

This is the star of the show. Nirmata is an AI agent specifically fine-tuned on crypto market data.

- How it works: You don’t just get a chart. You can ask Nirmata: “Why is Ethereum lagging behind Bitcoin today?” or “What is the support level for SOL based on current volume?”

- The Difference: Unlike ChatGPT (which cuts off at a certain date or gives generic advice), Nirmata has access to Biyond’s real-time data pipeline. It gives you answers based on today’s market conditions.

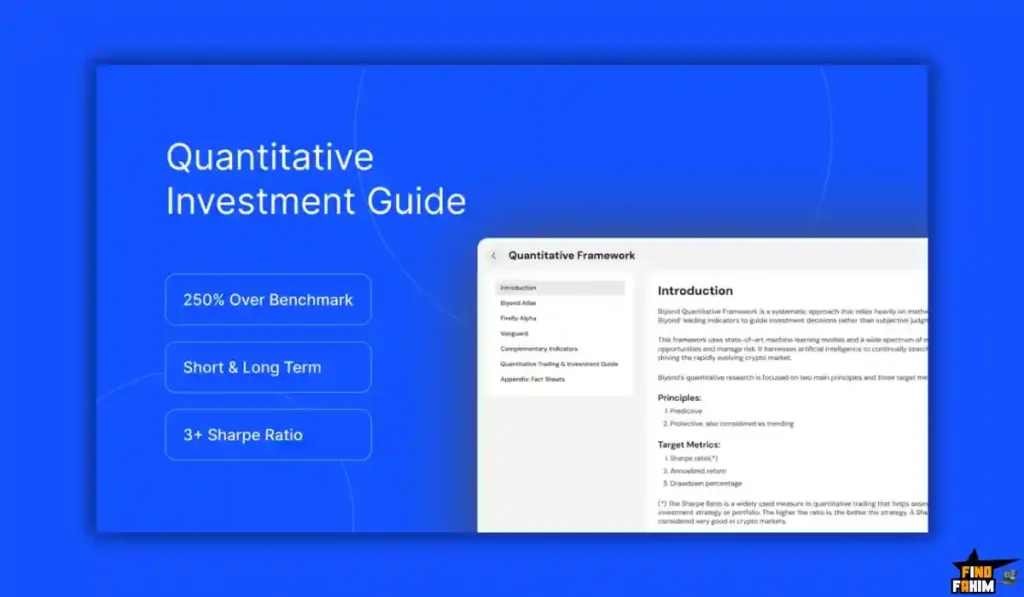

2. The Quantitative Framework (Signals)

The Benefit: Removing emotion from your entries.

Biyond uses a proprietary model to grade assets.

- Trend Identification: It clearly labels the market trend as “Bullish,” “Bearish,” or “Neutral.” This sounds simple, but 50% of losses come from trading against the trend.

- Timeframes: Tier 1 gives you 3D (3-Day) timeframes, which are great for swing trading. Tier 2 unlocks the 1D (Daily) timeframe, which gives you faster signals for shorter-term moves.

3. Market Sentiment Tracking

The Benefit: Spotting tops and bottoms.

“Be fearful when others are greedy.” We all know the quote, but how do you measure it?

- The Tech: Biyond scans millions of data points—social media volume, news sentiment, volatility index—to create a Sentiment Score.

- Use Case: If the price of Bitcoin is rising, but It’s sentiment indicator is flashing “Extreme Greed” and divergence, it’s a strong signal to take profits before the crash.

4. The “Trade Blotter” & Daily Analysis

The Benefit: Daily discipline.

- Daily Commentary: You receive expert-led market updates. This isn’t just “news”; it’s interpretation. “The Fed raised rates; here is why that is actually bullish for BTC dominance.”

- Top 5 / Top 150: Depending on your tier, you get a curated list of the top-performing assets. It saves you from scanning 20,000 junk coins on CoinGecko.

5. Education & Webinars

The Benefit: Learning to fish.

Biyond isn’t just a black box. They host Weekly Live Webinars.

- The Value: These aren’t sales pitches. They are market reviews where the founders and analysts look at the charts live, answer user questions, and explain how they are using the Biyond tools to make decisions. For a beginner, this mentorship is worth the price alone.

The Standout Feature: “Nirmata” (The AI Analyst)

While the signals are great, Nirmata is the game-changer.

Most crypto tools are “Static.” They give you a dashboard and say, “Good luck.”

Nirmata makes Biyond “Dynamic.”

- Scenario: You see a sudden 10% drop in Cardano (ADA).

- Old Way: You rush to Twitter, scroll through scams and bots, trying to find out why.

- Biyond Way: You type into Nirmata: “What caused the ADA drop just now?”

- The Result: Nirmata analyzes the news feed and on-chain data and replies: “The drop correlates with a large wallet unlocking 50M tokens and a bearish sentiment shift following the latest governance vote.”

- The Value: Instant clarity. No panic selling.

How Does Biyond Work? (A Quick Workflow)

Here is how you would use Biyond in your daily routine (15 minutes/day).

- Step 1: Check the “Market Pulse.”

Log in and look at the global sentiment dashboard. Is the market in “Risk On” or “Risk Off” mode? If it’s “Risk Off” (Bearish), you sit on your hands. - Step 2: Review the “Top Opportunities.”

Biyond highlights coins that have just triggered a “Buy” signal based on their quant model. Let’s say it flags Solana (SOL). - Step 3: Consult Nirmata.

You ask the AI: “What are the key resistance levels for SOL above $150?” Nirmata gives you the technical levels. - Step 4: Verify on the chart.

You open the chart to visually confirm the signal matches your own eye. - Step 5: Set Alerts.

You set a price alert in Biyond to notify you if the trend flips. - Step 6: Execute.

You go to your exchange (Binance/Coinbase) and place the trade with confidence.

Biyond Pricing & AppSumo Deal Details

This is a Tiered Lifetime Deal. The main difference is the Number of Coins and AI Usage.

The Tier Breakdown (Complete)

| Feature | License Tier 1 | License Tier 2 (Recommended) |

| Price | $59 | $269 |

| Normal Value | $468/yr | $2,000+/yr |

| Coin Coverage | Top 5 Coins (BTC, ETH +3) | Top 150 Coins (Detailed Altcoin Data) |

| Timeframes | 3D & Higher (Swing Trade) | 1D & Higher (Active Trade) |

| Nirmata AI | 1 Query / Day | Unlimited Queries |

| Access Level | Partial | Full Access |

| Webinars | ✅ Included | ✅ Included |

| Discord Access | ✅ Included | ✅ Included |

| Updates | All Future Basic Updates | All Future Pro Updates |

ROI Anchor Logic: The “Hidden Math”

TokenMetrics Basic Plan costs $39/month. That is $468 per year.

Biyond Tier 2 is $269 (one-time).

The Reality:

- You pay once what you would pay for 6 months of a competitor.

- If you are trading with a $5,000 portfolio, avoiding one bad trade because Biyond warned you about “Bearish Sentiment” will pay for the Tier 2 license immediately.

My Recommendation

Buy Tier 2 ($269).

Why?

Tier 1 is a “Demo.” Seriously. Only having data on the “Top 5 Coins” (Bitcoin, Ethereum, BNB, etc.) is very limiting. Most of the money in crypto is made in mid-cap altcoins (the Top 150).

To get the true “Alpha,” you need the Top 150 coverage and Unlimited AI Queries. You want to be able to ask Nirmata 50 questions a day, not just one.

If you strictly “Buy and Hold” only Bitcoin and Ethereum, Tier 1 ($59) is fine. But for anyone active, Tier 2 is the mandatory upgrade.

See All Biyond Deal Plans & Get Lifetime Access

Pros & Cons of This Lifetime Package

I analyzed the feedback from 33 verified purchasers and combined it with my own testing of the “Nirmata” AI.

The Pros

- Institutional Framework: It doesn’t just give you “Buy” signals. It gives you the context (Risk/Reward, Sentiment, Volatility). It teaches you to think like a fund manager.

- “Nirmata” AI Quality: Unlike generic ChatGPT wrappers, this AI is actually useful for specific crypto queries (“What is the support for LINK?”). It saves hours of research.

- Active Development: The team is releasing major updates (like “Vanguard 3.0”) frequently. They are clearly building for the long term, not just a quick cash grab.

- Community: The weekly webinars with the founders are a massive value-add. You get direct access to expert analysis every week for free.

- The Price: Paying $269 once for professional-grade data on 150+ coins is a steal compared to paying $100/month for TokenMetrics.

The Cons

- Coin Coverage: Tier 1 is extremely limited (Top 5 coins only). Even Tier 2 (Top 150) might miss some of your favorite “micro-cap” gems if you are a degenerate trader.

- No Copy Trading: You cannot connect it to Binance to auto-trade. You have to execute the trades yourself manually. (This is due to US regulations.

- Learning Curve: It is a “Quant” tool. It uses terms like “Sharpe Ratio” and “Volatility.” If you are a complete beginner, it might feel overwhelming at first.

Best Use Cases for Biyond

Who actually needs this platform? Here are 3 specific avatars that will get massive ROI.

1. The “Swing Trader” (Tier 2)

The Scenario: You trade the weekly trends. You want to catch the 20-30% moves in Altcoins like Solana or Avalanche.

The Biyond Fix: You use the 1D (Daily) timeframes on Tier 2. When It flips from “Neutral” to “Bullish” on a top 20 coin, you enter. You use the Sentiment Analysis to exit before the crowd panics.

2. The “DCA” Investor (Tier 1)

The Scenario: You just want to accumulate Bitcoin and Ethereum for the long term.

The Biyond Fix: You buy Tier 1 ($59). You don’t need daily signals. You just need the 3D (3-Day) trend. When the 3D trend is Bullish, you buy more heavily. When it’s Bearish, you pause your DCA or buy less. It optimizes your entry price over the years.

3. The “Research Junkie.”

The Scenario: You spend 3 hours a day on Twitter and YouTube trying to understand the market.

The Biyond Fix: You use Nirmata (Unlimited Queries on Tier 2). Instead of doom-scrolling, you ask Nirmata: “Summarize the catalyst for the recent Aptos pump.” You get the answer in seconds. You reclaim 2 hours of your day.

Get the Biyond Lifetime Deal on AppSumo

Biyond Alternatives

Is Biyond the best AI tool, or are there better options? The crypto tool landscape is crowded. Let’s compare it against the Top 5 competitors.

Biyond vs TokenMetrics

TokenMetrics is the 800lb gorilla in AI crypto analysis.

Where TokenMetrics Wins

Depth of Data. TokenMetrics covers thousands of coins, including tiny micro-caps. It has very advanced “Indices” that auto-rebalance portfolios. If you have a large portfolio ($100k+) and want automated strategies, TokenMetrics is deeper.

Where Biyond Wins

Price & Simplicity. TokenMetrics is expensive ($40/mo to $100/mo). Biyond Tier 2 is $269 (One-time). For 90% of traders who just stick to the Top 150 coins, this ai tool gives you similar “AI Grade” insights for a fraction of the cost. Biyond’s UI is also much cleaner and less cluttered.

Verdict: TokenMetrics for Whales; Biyond for Retail Traders.

Biyond vs TradingView (Paid)

TradingView is the standard charting platform.

Where TradingView Wins

Charting Power. Nothing beats TradingView for drawing lines, Fibonacci retracements, and custom indicators (Pine Script). It is the best visual tool.

Where Biyond Wins

Context & AI. TradingView shows you what is happening (Price). This finance tool tells you why (Sentiment/Quant Models). TradingView doesn’t have an AI analyst you can talk to. Biyond validates your TradingView charts with hard data.

Verdict: Use both. TradingView for charts; Biyond for confirmation.

Biyond vs CoinStats

CoinStats is primarily a portfolio tracker.

Where CoinStats Wins

Portfolio Tracking. CoinStats connects to all your wallets (Metamask, Ledger, Binance) and tracks your PnL automatically. It is the best dashboard for seeing “How much money do I have?”

Where Biyond Wins

Predictive Intelligence. CoinStats is a “mirror”—it shows you what you own. Biyond is a “telescope”—it shows you where the market is going. CoinStats won’t tell you to sell before a crash; It’s sentiment analysis might.

Verdict: CoinStats for Tracking; Biyond for Strategy.

Biyond vs Santiment

Santiment is the leader in “On-Chain” data.

Where Santiment Wins

Raw On-Chain Data. If you want to know exactly how many whales moved ETH to exchanges in the last hour, Santiment is the king. It is a tool for data scientists and hardcore analysts.

Where Biyond Wins

Actionability. Santiment gives you raw data; you have to interpret it. Biyond processes that data into a simple “Bullish/Bearish” signal. It is for traders who want answers, not just spreadsheets.

Verdict: Santiment for Analysts; Biyond for Traders.

Biyond vs Messari

Messari is the “Bloomberg” of crypto research.

Where Messari Wins

Long-Form Research. Messari publishes 50-page reports on protocols. If you are a VC or doing deep fundamental diligence on a project’s tokenomics, Messari is the bible.

Where Biyond Wins

Trading Signals. Messari is great for reading, but it doesn’t give you “Buy/Sell” signals for this week. Biyond is tactical. It helps you navigate the volatility of the market right now.

Verdict: Messari for Investing; Biyond for Trading.

All Competitors Matrix

| Feature | Biyond | TokenMetrics | TradingView | CoinStats | Santiment | Messari |

| Pricing | Lifetime ($59+) | $40+/mo | $15+/mo | Free/$20 | $49+/mo | $300+/mo |

| AI Analyst | ✅ Nirmata | ✅ Yes | ❌ No | ❌ No | ❌ No | ✅ AI Search |

| Signals | ✅ Quant | ✅ AI | ❌ Manual | ❌ No | ❌ Raw Data | ❌ Research |

| Sentiment | ✅ Included | ✅ Yes | ❌ Basic | ❌ No | ✅ Deep | ❌ No |

| Coin Coverage | ~150 | 6,000+ | All | All | 2,000+ | 1,000+ |

| Best For… | Traders | Whales | Chartists | Tracking | Analysts | VCs |

Who Should NOT Buy Biyond?

I want to be honest, so you don’t waste your money.

- The “Degen” Memecoin Trader: If you only trade coins with market caps under $10M (like PEPE or WIF early days), Biyond won’t help you. It focuses on the Top 150 established coins with liquidity. It doesn’t track 1-hour-old tokens on Solana.

- The “High-Frequency” Scalper: Biyond’s fastest timeframe is Daily (1D). If you are scalping 1-minute or 5-minute charts, Biyond’s signals will be too slow for you. It is for Swing Trading, not Scalping.

Is This Lifetime Deal a Smart Business Investment?

Let’s do the financial math for Tier 2 ($269).

Scenario: You manage a $5,000 crypto portfolio.

- Option A (Subscription Tools):

- TokenMetrics Basic: $40/mo.

- TradingView Pro: $15/mo.

- Yearly Cost: $660.

- Option B (Biyond):

- Total: $269 (One-time payment).

The ROI Math:

- You break even in 5 months.

- Over 3 years, you save $1,700+.

- If Biyond helps you avoid just one 20% crash on your $5k portfolio (saving you $1,000), the tool pays for itself 4x over instantly.

How to Redeem the Biyond Deal

- Buy: Purchase the codes on AppSumo.

- Tier Selection: Crucial Step: If you want access to the Top 150 Coins and Unlimited AI, you must buy Tier 2 ($269). Do not buy Tier 1 expecting to trade Altcoins.

- Redeem: Create an account on the Biyond website using the redemption link.

- Activate: Apply your code in the dashboard settings.

- Discord: Join the exclusive Discord community (link in dashboard) to access the weekly webinars.

Final Verdict: Is This Cost-Friendly Deal Worth It?

After testing Nirmata’s responses and the accuracy of the Quant signals, my final verdict is a solid 4.7 Stars.

Biyond is the “Intelligent Layer” your trading stack is missing.

- It gives you the Discipline of a Quant Fund.

- It gives you the Insight of an AI Analyst.

- It gives you the Value of a Lifetime Deal.

If you are tired of trading on emotion and want to build a serious, data-driven portfolio, Biyond Tier 2 is one of the smartest investments you can make in 2026.

Secure Your Lifetime Access to Biyond Now

Note: AppSumo deals usually last 2-3 weeks. Don’t wait until the next bull run starts without it.

About the Author

I have been investing in crypto since 2017. I have survived the ICO boom, the DeFi summer, and the FTX crash. I know how painful it is to trade on “gut feeling” and lose money.

I write these reviews to help other retail investors find the tools that actually level the playing field against the whales. I use Biyond personally to validate my swing trade entries on major altcoins.

If you want to see the other tools I trust, check out my full AppSumo deal reviews page.

FAQ: Your Biyond Questions, Answered

Biyond is an AI-powered cryptocurrency research and signal platform that helps users decide what and when to buy or sell, while trade execution is done manually on their own exchange.

No, Biyond does not execute trades. It only provides research insights and buy or sell signals, and users must place trades themselves on their preferred exchange.

Copy trading is currently disabled due to US regulatory restrictions, so users must manually execute trades based on provided signals.

Since Biyond does not trade on your behalf, you can use its signals on any exchange including Binance, Coinbase, Kraken, or decentralized exchanges like Uniswap.

No, Biyond is fully focused on the cryptocurrency market and does not provide analysis or signals for stocks or traditional assets.

Biyond’s AI, Nirmata, is highly accurate for market explanations and data insights, but price predictions are probabilistic and should be used as guidance rather than guarantees.

Tier 1 includes the top 5 cryptocurrencies such as Bitcoin, Ethereum, BNB, Solana, and XRP.

Tier 2 covers the top 150 cryptocurrencies, including major DeFi, Layer 1, Layer 2, and AI-related tokens.

Upgrades are only possible while the AppSumo deal is live. Once the deal ends, tier upgrades will no longer be available.

Biyond is currently web-based, but the platform is fully mobile-responsive and works well on smartphone browsers.

The Quant Framework is a mathematical scoring system that evaluates crypto assets using trend, momentum, volatility, and volume to show bullish or bearish conditions.

Yes, both Tier 1 and Tier 2 users get access to the official Discord community where founders and users actively share insights.

Yes, beginners can use Biyond with the help of educational webinars, although learning basic trading terminology is recommended for best results.

AI crypto tools are safest when used as research aids rather than decision-makers, helping beginners understand trends while managing their own risk.

No crypto signals can guarantee profits, but high-quality research tools help improve decision-making and risk awareness. What is Biyond?

Does Biyond execute trades automatically?

Why is copy trading disabled on Biyond?

Which crypto exchanges can I use with Biyond?

Does Biyond support stock market trading?

How accurate is Biyond AI analysis?

What cryptocurrencies are included in Tier 1?

What is included in Biyond Tier 2?

Can I upgrade from Tier 1 to Tier 2 later?

Is there a Biyond mobile app?

What is the Quant Framework used by Biyond?

Does Biyond include a community or Discord access?

Is Biyond suitable for beginners in crypto?

Is AI crypto trading safe for beginners?

Can crypto signals guarantee profits?

Hi, I’m Fahim — a SaaS tools reviewer and digital marketing expert with hands-on experience helping businesses grow using the right software. I research, test, and personally use a wide range of AI, business, productivity, marketing, and email tools for my agency, clients, and projects. I create honest, in-depth reviews and guides to help entrepreneurs, freelancers, startups, and digital agencies choose the best tools to save time, boost results, and scale smarter. If I recommend it, I’ve used it — and I only share what truly works.