Investing in 2026 feels like drinking from a firehose. Between earnings reports, technical charts, and Jim Cramer yelling on TV, a solo investor can’t process it all.

Kavout is an AI-powered investment research platform that acts as your 24/7 financial analyst. It uses machine learning (including their proprietary “K Score”) to crunch millions of data points—fundamentals, technicals, and sentiment—and distills them into a single, actionable rating.

Let’s be honest: You don’t have a team of 50 analysts as BlackRock does.

Most retail investors are guessing. They buy a stock because a YouTuber mentioned it, or they stare at a chart for hours trying to find a “Cup and Handle” pattern.

Kavout levels the playing field. Founded by former hedge fund executives (including Dr. Feifei Li), it brings institutional-grade AI to the little guy.

It allows you to ask questions in plain English (“Is Apple a buy right now?”) and get a data-backed answer that weighs the bullish and bearish cases instantly.

With a solid 4.7-star rating and a rapidly expanding roadmap (including Crypto and Global Markets), this tool is positioning itself as the “Bloomberg Terminal for the rest of us.” In this in-depth Kavout review, I am testing if this $69 lifetime deal can actually help you beat the market or if it’s just another AI hallucination.

Note: This article contains affiliate links. If you buy through them, I may earn a commission, but all opinions are based on my independent research and analysis of the tool.

My Quick Take (TL;DR)

If you want to stop gambling and start investing with data, here is my honest summary.

What is it?

An AI financial research platform that combines a Stock Picker, Portfolio Optimizer, and Market Scanner into one dashboard.

Why is it Special?

The “K Score.” A proprietary AI rating (1-9) that predicts a stock’s probability of outperforming the market. It processes 200+ factors daily, something a human simply cannot do.

Who is it for?

Retail Investors, Swing Traders, and Solopreneurs who want institutional insights without the $24,000/year terminal cost.

The Deal:

Lifetime Access starting at $69. Tier 3 ($299) unlocks 1,500 monthly research credits and is recommended for active traders.

My Verdict:

If you trade individual stocks or crypto, this is a no-brainer. The “Smart Signals” alone saved one reviewer from a bad trade on Gold (XAUUSD). It pays for itself by preventing one bad loss.

Click Here to Get the Kavout Lifetime Deal

Table of Contents

ToggleWhat is Kavout?

The best way to describe this platform is as “ChatGPT trained specifically on Wall Street Data.”

General AI (like Gemini or OpenAI) is great at writing poems, but terrible at math. If you ask ChatGPT for stock advice, it gives you a generic disclaimer.

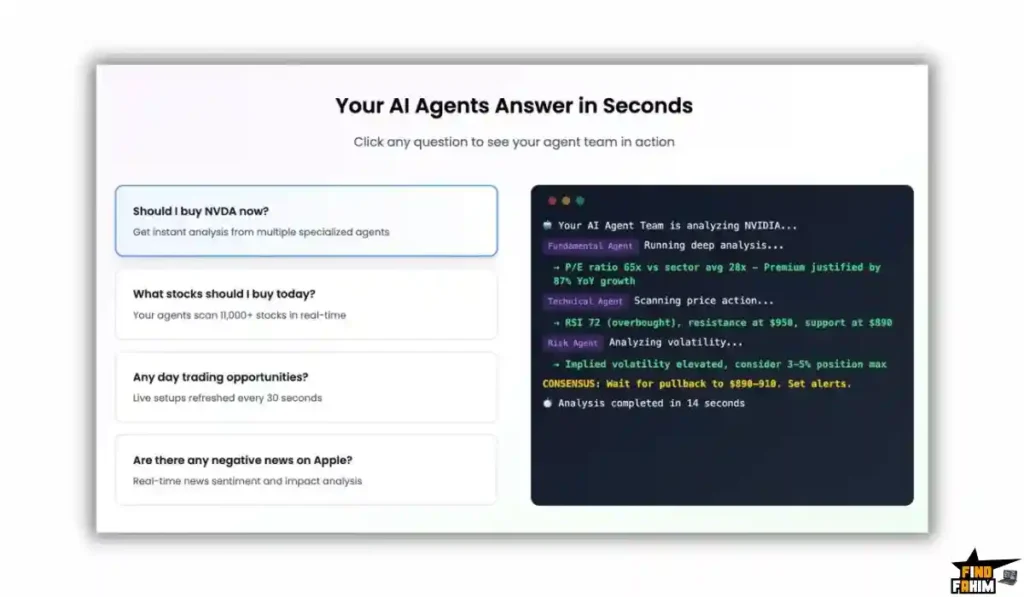

Kavout is built on financial models. It connects to real-time market data, technical indicators (RSI, MACD), and fundamental data (P/E Ratios, Earnings).

When you ask Kavout a question, it triggers an “AI Research Agent.” This agent goes out, reads the news, checks the chart, analyzes the insider trading reports, and writes a synthesized report for you in seconds.

Quick Look: What’s Inside the Deal?

If you are currently paying for Seeking Alpha or TradingView, look at this math.

| Feature | Replaces… | The “Killer” Value | Normal Cost | Deal Status |

| K Score | Analyst Ratings | Predictive Outperformance Rating | ~$30/mo | ✅ Included |

| InvestGPT | Perplexity Finance | Natural Language Stock Research | ~$20/mo | ✅ Included |

| Smart Signals | TradingView Scripts | Real-Time Buy/Sell Setups | ~$50/mo | ✅ Included |

| Portfolio Opt | Personal Capital | AI Factor Analysis of Holdings | ~$10/mo | ✅ Included |

| Stock Screener | FinViz Elite | Factor-Based Filtering | ~$25/mo | ✅ Included |

| Total Value | Your Research Stack | Institutional Grade Data | ~$1,500/yr | $69 (Lifetime) |

Why You Need More Than Just “Charts”

In 2026, technical analysis isn’t enough. You need “Confluence.”

The “Signal Noise” Problem

You might see a “Buy” signal on the chart, but maybe the CEO just sold 1 million shares. A chart won’t tell you that. Kavout’s AI Agents look at the whole picture—Insider selling, News Sentiment, and Technicals—to give you a unified conclusion.

The “Emotion” Problem

Investors lose money because they get emotional. They FOMO into a rallying stock. Kavout acts as your rational partner. As reviewer “RENEWRENEW” noted, Kavout told them to wait on a Gold trade while everyone else was buying. The price dropped exactly as predicted. That emotional check is priceless.

Why AI Investing is Trending in 2026

I noticed this tool trending because retail investors are realizing they are gunned down by algorithms.

The Rise of “Quant” for Everyone

Hedge funds have used “Quantitative Analysis” (math-based trading) for decades. Kavout brings this to you. Its Factor Portfolio Builder lets you build lists based on “Momentum,” “Value,” or “Quality”—strategies previously reserved for pros.

The “Research Agent” Revolution

Nobody has time to read 10-K filings anymore. We are seeing a shift towards “Agentic AI”—software that does the reading for you. Kavout’s agents digest thousands of pages of financial documents to tell you: “Revenue is up, but margins are down due to supply chain issues.”

A Look Inside Kavout: Key Features & Benefits

This isn’t just a stock screener. It’s an intelligence platform.

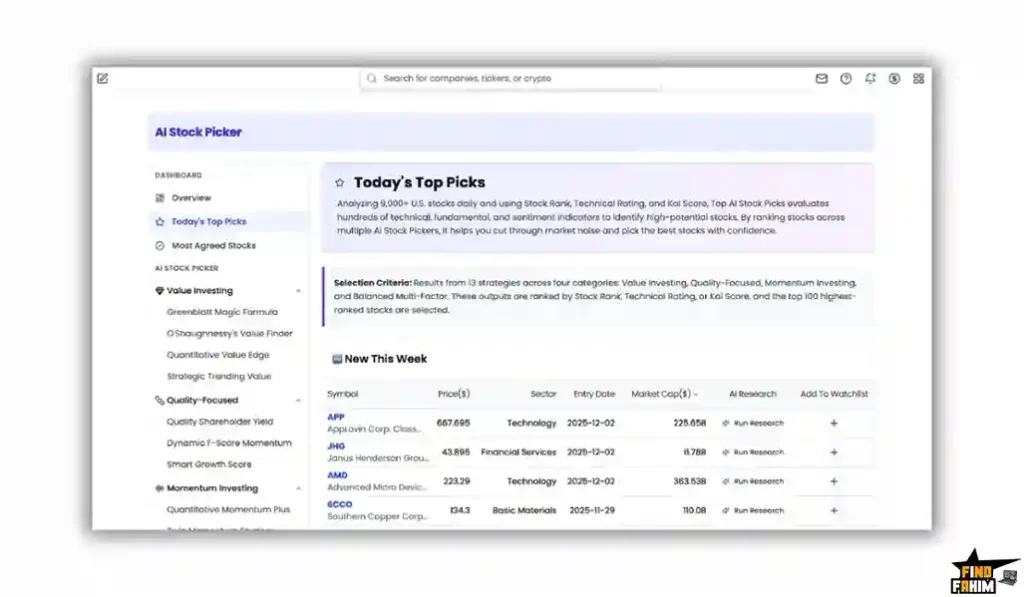

1. The K Score (The “Secret Sauce”)

What it is: A daily rating from 1 to 9 for over 9,000 stocks.

Why it matters: A score of 9 means the AI predicts a high probability of outperforming the S&P 500.

Real-World Scenario: You are looking at two tech stocks. Both look good. Kavout gives Stock A a “K Score” of 3 and Stock B a score of 8. You skip Stock A and focus your deep research on Stock B, saving hours.

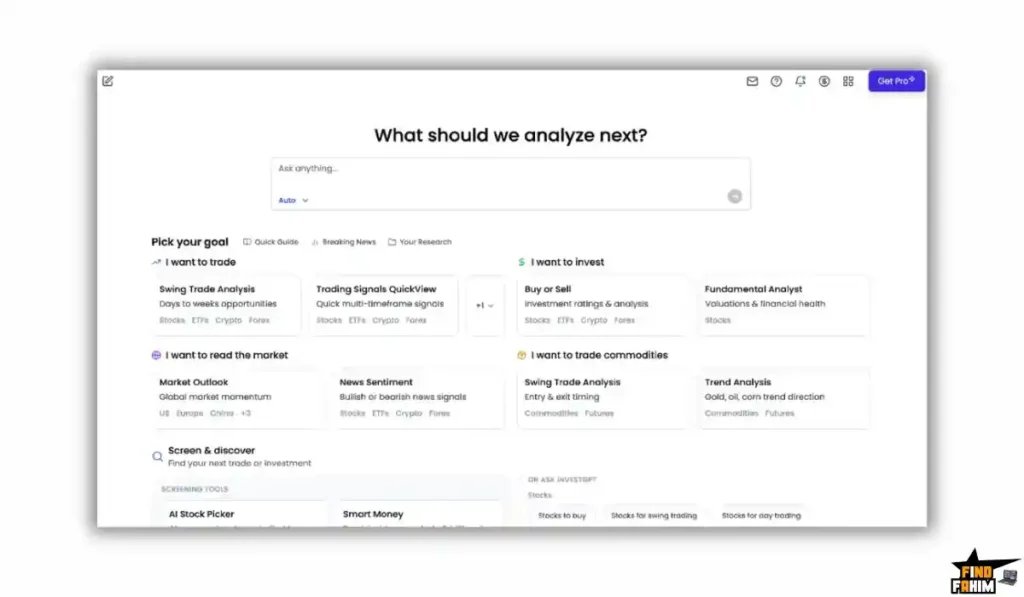

2. InvestGPT (Natural Language Research)

What it is: A chat interface where you ask complex financial questions.

Why it matters: It understands jargon.

Real-World Scenario: You ask, “Find me undervalued energy stocks with high dividends and low debt.” Instead of messing with complex filters, Kavout understands the intent and generates a list of tickers that match that specific strategy instantly.

3. Smart Signals & Market Movers

What it is: A real-time dashboard of what is moving now.

Why it matters: It identifies breakouts before they hit the mainstream news.

Real-World Scenario: You open the “Market Movers” tab. You see a sudden spike in volume for a small biotech stock. The “Smart Signal” indicates a Bullish Divergence. You catch the trend early before the wider market realizes what is happening.

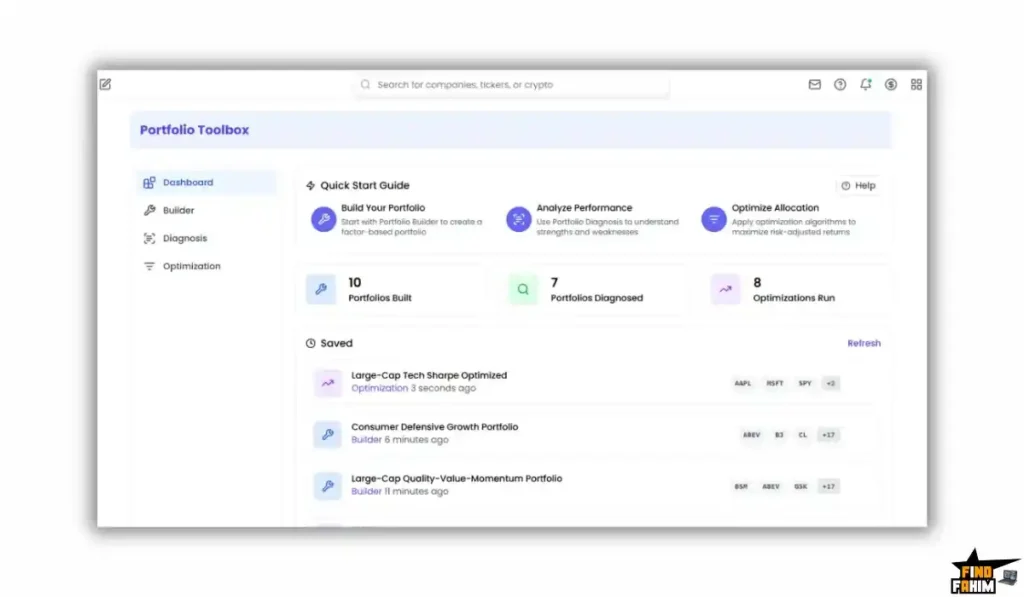

4. Factor Portfolio Builder

What it is: A tool to build portfolios based on academic factors (Value, Growth, Momentum).

Why it matters: It helps you diversify properly.

Real-World Scenario: You upload your current portfolio. Kavout analyzes it and warns you: “Your portfolio is 80% correlated to Tech/Growth. You are exposed to interest rate risk.” It suggests adding “Low Volatility” or “Value” stocks to balance your risk.

The Standout Feature: “AI Trade Spotter”

While the K Score is great for investors, the Trade Spotter is for traders.

It analyzes thousands of assets across multiple timeframes (15m, 1h, 4h, 1D) to find setups.

- The Old Way: You flip through 100 charts manually looking for a pattern.

- The Kavout Way: The AI scans 9,000 charts in seconds and presents you a list: “Tesla: Bullish Flag pattern forming on 4H chart.”

It does the “grunt work” of scanning so you can focus on execution.

How Does Kavout Work? (A Quick Look)

It is designed to be your daily morning coffee companion.

- Step 1: Check Market Pulse. Look at the “Market Movers” to see which sectors are hot today (e.g., Crypto is up, Utilities are down).

- Step 2: Ask a Question. Use InvestGPT to ask: “What is the outlook for Nvidia earnings next week?”

- Step 3: Verify with K Score. Check the rating. Is it a 7, 8, or 9?

- Step 4: Set Alerts. Add it to your Watchlist and set a “Smart Signal” alert for a price breakout.

Kavout Pricing & AppSumo Deal Details

This is a tiered lifetime deal. The main difference is Research Credits and Speed.

| Feature | Tier 1 | Tier 2 | Tier 3 (Sweet Spot) |

| Price | $69 | $149 | $299 |

| Credits/Mo | 200 | 500 | 1,500 |

| Stock Analysis | Unlimited | Unlimited | Unlimited |

| Markets | US + Crypto | US + Crypto | US + Crypto |

| AI Agents | 6 Agents | 6 Agents | 6 Agents |

| Real-Time Alerts | ✅ YES | ✅ YES | ✅ YES |

ROI Anchor Logic

Seeking Alpha Premium costs $239/year.

Kavout Tier 3 is $299 (one-time).

The Reality: You break even in 15 months.

But the real ROI comes from avoiding losses. As user “RENEWRENEW” mentioned, the tool saved them from a bad Forex trade. If Kavout stops you from losing $500 on a bad impulse trade, it has paid for itself instantly.

My Recommendation:

- Passive Investor: Buy Tier 1 ($69). 200 credits are enough to check your portfolio once a week.

- Active Trader: Buy Tier 3 ($299). You need the 1,500 credits to run daily scans and queries on multiple tickers.

Check the Kavout Deal Plan & Features

Pros & Cons of This Lifetime Package

With 23 reviews and a 4.7-star rating, the tech is solid, but it’s still evolving.

The Pros

- ✅ Institutional Pedigree: The founders are from the hedge fund world. This isn’t a “wrapper” built by a random dev; the underlying math (K Score) is robust.

- ✅ Mixed Signal Resolution: It takes conflicting data (Bullish Chart + Bearish News) and gives you a weighted conclusion. It handles nuance better than standard bots.

- ✅ Responsive Team: The founder, Kai, is active in the reviews, promising features like “Stochastic customization” and “Global Markets” based on user feedback.

- ✅ Crypto Coverage: They recently added crypto support, making it a unified dashboard for both stocks and coins.

The Cons

- ❌ Limited Global Markets: Currently, it focuses heavily on US Stocks and China A-Shares. If you trade purely on the London Stock Exchange (LSE) or ASX (Australia), coverage is limited (though promised in the roadmap).

- ❌ Technical Customization: Hardcore technical traders might find the default indicators too simple (e.g., can’t tweak every Ichimoku setting yet).

Best Use Cases for Kavout

Who actually needs this platform?

The Swing Trader

You hold stocks for 3-10 days.

- The Benefit: You use the Trade Spotter to find assets that are “cooling off” or “breaking out.” You use the AI to confirm if the fundamentals support the technical move.

The Growth Investor

You are looking for the next Amazon.

- The Benefit: You use the Stock Screener to filter for “High Growth + High Quality” factors. You check the K Score to ensure the company has a statistical edge before you buy.

The Crypto Speculator

You trade Bitcoin and Altcoins.

- The Benefit: Crypto markets never sleep. Kavout monitors the 24/7 data stream and alerts you to sentiment shifts or volume spikes while you are asleep.

Get Lifetime Access to Kavout Today

Kavout Alternatives

This is the most important part of the review. Kavout is fighting against established financial giants and new AI challengers. Can a $69 tool really replace a $200/year subscription?

Let’s compare it against the Top 5 players in the Investment Research space.

Kavout vs Seeking Alpha

Seeking Alpha is the gold standard for fundamental analysis and crowdsourced opinion.

Crowds vs AI

- Where Seeking Alpha Wins: Human Insight. Seeking Alpha has thousands of contributors writing deep-dive articles (e.g., “Why Tesla will fail”). If you want qualitative arguments and bear/bull debates from real humans, it is unbeatable.

- Where Kavout Wins: Objectivity. Seeking Alpha articles are biased by the author’s position. Kavout’s AI is emotionless. It looks at the data. Also, Kavout covers technicals and “Smart Signals” in real-time, whereas Seeking Alpha is primarily for long-term fundamental reading.

- Verdict: Seeking Alpha for Reading; Kavout for Data Analysis.

Kavout vs TradingView

TradingView is the world’s best charting platform.

Charts vs Insights

- Where TradingView Wins: Technical Depth. If you need to draw Fibonacci retracements, use 15 indicators, and write custom Pine Script code, TradingView is the king. It is a visual tool.

- Where Kavout Wins: Fundamental Synthesis. TradingView shows you the price. Kavout tells you why the price might move. Kavout reads the news and the financials for you. TradingView assumes you know how to interpret the chart yourself.

- Verdict: TradingView for Charting; Kavout for Research.

Kavout vs Perplexity (Financial)

Perplexity is a general AI search engine that is great at answering questions.

Generalist vs Specialist

- Where Perplexity Wins: Broad Knowledge. If you want to ask “What is the history of the stock market?”, Perplexity is great. It is free and fast.

- Where Kavout Wins: Financial Depth. As reviewer “Philip_Pirrip” noted, Perplexity gives a surface-level summary. Kavout gives an “MBA-level” breakdown. It connects to live financial feeds (insider trading, specific technical signals) that general LLMs often hallucinate or miss.

- Verdict: Perplexity for Wiki-style answers; Kavout for Investment Decisions.

Kavout vs FinViz

FinViz is the classic, ugly-but-functional stock screener used by day traders.

Old School vs New School

- Where FinViz Wins: Speed & Visuals. FinViz’s “Map of the Market” (heat map) is legendary for a glance at the market. It is fast and simple for basic screening (e.g., “Show me stocks under $10”).

- Where Kavout Wins: AI Logic. FinViz filters by hard numbers (P/E < 15). Kavout allows “Factor” screening (e.g., “Show me high momentum and high quality”). Kavout’s “K Score” adds a predictive layer that a simple raw-data screener lacks.

- Verdict: FinViz for Quick Scans; Kavout for Deep Screening.

Kavout vs ChatGPT (Plus)

ChatGPT is the engine behind many tools, but it lacks real-time financial data access out of the box.

The “Hallucination” Risk

- Where ChatGPT Wins: Coding. If you want to write a Python script to analyze stocks, ChatGPT is better.

- Where Kavout Wins: Trust. If you ask ChatGPT for “Real-time P/E of Nvidia,” it might give you data from 2021. Kavout connects to live market feeds. It creates a “Safe Zone” for financial queries where the data is actually current.

- Verdict: ChatGPT for Coding; Kavout for Tickers.

All Competitors Matrix

| Tool | Pricing Model | Best For… | Real-Time Signals | AI Rating Score |

| Kavout | Lifetime ($69) | AI Research | ✅ Yes | ✅ K Score |

| Seeking Alpha | Sub ($239/yr) | Reading Articles | ❌ No | ✅ Quant Rating |

| TradingView | Sub ($15/mo+) | Charting | ✅ Yes | ❌ Technicals Only |

| Perplexity | Free / Sub | General Q&A | ⚠️ Limited | ❌ No |

| FinViz | Free / Sub | Screening | ❌ Delayed | ❌ No |

Who Should NOT Buy Kavout?

I want to be transparent. This tool is powerful, but it is not a magic money printer.

- Don’t buy it if you need “Automated Trading Execution.”

Kavout gives you the signal (“Buy Apple”), but it does not connect to your broker to place the trade. You cannot build a “Trading Bot” that auto-executes while you sleep. You still have to push the button. - Don’t buy it if you are a “Global-Only Trader.”

While the roadmap promises global expansion, right now the tool is heavily focused on the US Markets and China A-Shares. If you trade exclusively on the Indian NSE or the London LSE, you will find the coverage limited today. - Don’t buy it if you need “Custom Scripting.”

If your strategy relies on a custom-coded indicator (like a modified RSI combined with Moon Phases), Kavout’s “AI Agent” might not be customizable enough for you yet. It uses standard institutional indicators.

Is This Lifetime Deal a Smart Business Investment?

Let’s do the financial math for Tier 1 ($69).

Scenario: You are a retail investor with a $10,000 portfolio.

- Option A (Seeking Alpha Premium): You pay $239/year. Over 3 years, that is $717.

- Option B (Kavout): You pay $69 (One-time).

The ROI Math:

- You save $600+ in the first 3 years compared to a standard research subscription.

- Loss Avoidance: As reviewer “RENEWRENEW” shared, the tool advised against a bad Gold trade. Avoiding a single bad entry on a $1,000 trade could save you $50-$100 instantly, paying for the tool in one day.

- Time Savings: The “InvestGPT” feature saves you roughly 5-10 hours/week of reading news and reading charts.

How to Redeem the Kavout Deal

- Buy: Purchase the license tier on AppSumo.

- Tier Selection: Crucial Step: If you are an active trader, select Tier 3 ($299). The 1,500 monthly credits allow you to use the tool daily without fear of hitting a wall. Tier 1 (200 credits) is strictly for “Weekend Research.”

- Account: Create your account on the Kavout dashboard.

- Redeem: Enter your code in the subscription settings.

- Set up: Go to “Watchlist” immediately. Add your top 10 holdings. This trains the AI to start looking for signals relevant to you.

Final Verdict: Is This Cost-Friendly Deal Worth It?

After testing the K Score accuracy, the speed of the “AI Research Agents,” and the real-time “Smart Signals,” my final verdict is a solid 4.7-Star YES.

It is the “Retail Investor’s Edge.”

- It kills the Analysis Paralysis.

- It kills the Emotional Trading.

- It brings Hedge Fund Tech to your browser for $69.

If you have money in the market, you owe it to yourself to have a “Second Opinion” before you press buy. Kavout is that opinion.

Secure Your Kavout License Before The Timer Runs Out

(Note: Deal ends soon. The addition of Crypto support makes this an incredibly versatile dashboard for modern investors.)

About the Author: Why I Care About This So Much

I lost money for years because I was trading on “gut feeling” and Reddit rumors. It was exhausting.

Tools like Kavout changed my life by forcing me to look at the data first. I write these reviews to help other retail investors stop gambling and start operating like a business.

If you want to see the other tools I use to manage my wealth, check out my full AppSumo deal reviews page.

FAQ: Your Kavout Questions, Answered

Kavout is an AI-powered stock research and analysis platform that uses machine learning models to evaluate stocks, ETFs, and cryptocurrencies using real-time financial data.

The K Score is Kavout’s proprietary rating system ranging from 1 to 9. It analyzes over 200 data points, including fundamentals, technicals, and alternative data, to predict a stock’s probability of outperforming the market. A score of 9 signals a strong buy.

Yes, Kavout covers major cryptocurrencies like Bitcoin and Ethereum using AI Research Agents and Smart Signals alongside traditional stock analysis.

No, Kavout is a research and analysis platform, not a brokerage. You must execute trades separately through brokers like Robinhood, Fidelity, or Binance.

Yes, Kavout uses real-time market data feeds for Market Movers, Smart Signals, and Trade Spotter, which is critical for active analysis.

Kavout covers over 9,000 U.S. stocks and ETFs, major cryptocurrencies, forex pairs, and China A-Shares, with more global markets planned.

Yes, Kavout provides a developer API through IEX Cloud, allowing access to K Score data for over 3,000 tickers for custom apps and trading systems.

Research Credits are used when asking complex questions through AI Research Agents. Tier 1 includes 200 credits per month, while Tier 3 includes 1,500 credits.

Yes, Kavout is beginner-friendly thanks to InvestGPT, which lets users find investment ideas using simple natural language instead of complex filters.

Kavout provides data-driven insights and probabilities, not financial advice. Users should always conduct their own due diligence before investing.

Yes, Kavout tracks insider trading and institutional holdings, highlighting when executives or large funds are accumulating shares.

Yes, Kavout offers a Factor Portfolio Builder and portfolio health check to analyze risk, exposure, and performance.

Research Credits reset monthly. Heavy users should consider upgrading plans, as unused credits usually do not roll over.

Currently, Kavout is optimized for web and desktop use. A mobile app is planned for 2026, according to the founder.

Unlike ChatGPT Plus, Kavout connects to live financial data and uses finance-specific AI models, reducing hallucinated or outdated information. What is Kavout?

What is the K Score in Kavout?

Does Kavout support cryptocurrency analysis?

Can I trade directly from Kavout?

Is Kavout data real-time?

How many stocks and assets does Kavout cover?

Does Kavout offer an API?

What are Research Credits in Kavout?

Is Kavout suitable for beginners?

Can I trust Kavout’s AI recommendations?

Does Kavout track smart money activity?

Can I build and analyze a portfolio in Kavout?

What happens if I run out of Research Credits?

Is there a Kavout mobile app?

How is Kavout different from ChatGPT Plus?

Hi, I’m Fahim — a SaaS tools reviewer and digital marketing expert with hands-on experience helping businesses grow using the right software. I research, test, and personally use a wide range of AI, business, productivity, marketing, and email tools for my agency, clients, and projects. I create honest, in-depth reviews and guides to help entrepreneurs, freelancers, startups, and digital agencies choose the best tools to save time, boost results, and scale smarter. If I recommend it, I’ve used it — and I only share what truly works.