Picture this: a small business owner drowning in spreadsheets, struggling to track expenses and dreading tax season. Sound familiar? Here’s a surprising statistic: small businesses that switch to accounting software can save up to 15 hours weekly on financial management. For entrepreneurs juggling countless responsibilities, streamlined finances are not just a luxury—they’re a necessity.

The right accounting software simplifies record-keeping, enhances decision-making, and ensures compliance with ever-evolving tax regulations. With automation, accuracy, and scalability at your fingertips, your financial management shifts from a daunting task to a strategic advantage. Let’s explore why accounting software is crucial, the must-have features, and the top platforms for small businesses in 2024.

Table of Contents

ToggleWhy Accounting Software Is Crucial for Small Businesses

Common Challenges in Manual Bookkeeping

- Time-Consuming Processes: Managing books manually eats into valuable time that could be spent growing your business.

- High Error Rates: Manual calculations often lead to mistakes that can affect cash flow, compliance, and tax filings.

- Limited Insights: Traditional bookkeeping provides raw data but lacks the analytical depth needed for informed decision-making.

Benefits of Automating Financial Tasks

- Increased Accuracy: Automated systems reduce human errors and improve the reliability of financial data.

- Time-Saving Tools: Features like automatic invoicing, expense tracking, and reconciliation save hours of manual work.

- Scalability for Growth: As your business expands, accounting software can handle increased transactions, team access, and integrations.

Key Features to Look for in Accounting Software

User-Friendliness and Customization

A good accounting platform should offer an intuitive interface that doesn’t require advanced technical knowledge. Look for:

- Customizable Dashboards: Tailor views to prioritize financial metrics relevant to your business.

- Easy Navigation: Simplify access to essential functions like invoicing, payroll, and tax reports.

Integration With Other Tools

Modern businesses rely on interconnected systems. Ensure your accounting software integrates seamlessly with:

- Customer Relationship Management (CRM) tools to track client transactions.

- Payroll software to streamline employee payments and tax filings.

- Payment Gateways like Stripe or PayPal for simplified transaction management.

Cloud-Based Solutions

The rise of remote work and global commerce makes cloud accounting essential. Features to prioritize include:

- Accessibility: Manage your finances anytime, anywhere, using mobile apps or web access.

- Real-Time Collaboration: Share access with accountants or team members securely.

- Data Security: Look for encrypted servers and multi-factor authentication to protect sensitive information.

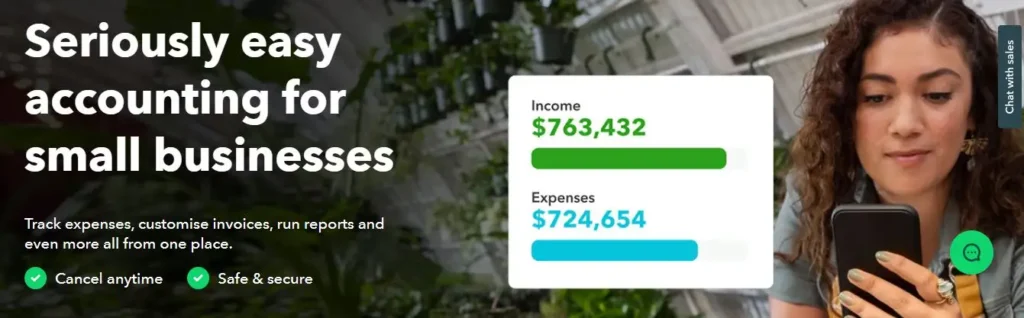

QuickBooks Online

Best For: Growing businesses with diverse financial needs.

QuickBooks Online (QBO) stands as a benchmark in the accounting software industry, boasting a comprehensive suite of features designed to handle the intricate financial requirements of small to mid-sized businesses.

Key Features

- Expense Management:

- Automated bank feeds categorize and track transactions in real time.

- Smart expense tracking helps identify tax-deductible expenses, reducing year-end hassles.

- Customizable Invoicing:

- Professional templates with the option to include logos and preferred layouts.

- Automated invoicing and payment reminders to streamline cash flow management.

- Tax Prep Tools:

- Integrates directly with TurboTax for seamless tax filing.

- Offers sales tax tracking and estimation.

- Scalability:

- Pricing tiers (Simple Start, Essentials, Plus, and Advanced) cater to varying business stages, from solopreneurs to enterprises.

- Features like batch invoicing and workflow automation are available in higher-tier plans for scaling businesses.

Pro Tips:

- Use the Advanced Reporting feature to track KPIs like profit margins and revenue growth.

- Utilize its inventory tracking in the “Plus” plan for real-time stock management.

Pricing:

Plans range from $30 to $200/month, depending on the business scale. Discounts often apply to new users.

More at QuickBooks Official.

Wave Accounting

Best For: Solo entrepreneurs and startups seeking budget-friendly solutions.

Wave provides an unparalleled offering of free accounting tools for small businesses. Its intuitive design makes it an excellent choice for those with little to no accounting background.

Key Features

- Completely Free Core Tools:

- Includes invoicing, accounting, and receipt scanning at no cost.

- Premium services like payment processing and payroll are optional add-ons.

- Invoice Management:

- Customizable invoices with real-time payment status tracking.

- Supports recurring billing and automatic reminders.

- Expense Tracking:

- The Mobile app allows receipt scanning for expense documentation.

- Tracks profit and loss in user-friendly dashboards.

- Built-In Reporting:

- Offers essential financial reports, such as income statements and cash flow projections.

Pro Tips:

- Freelancers and startups can use the payroll add-on for tax-compliant wage calculations.

- For e-commerce integration, Wave supports Shopify for seamless sales tracking.

Pricing:

- Core tools are free.

- Optional services:

- Payroll: $20–$35/month.

- Payment processing fees: 2.9% + $0.30 per transaction.

Learn more at Wave’s Website.

Xero

Best For: International small businesses with multi-currency needs.

Xero is a powerhouse for global businesses, offering advanced features like multi-currency accounting and unlimited users at all pricing tiers.

Key Features

- Global Accounting Support:

- Multi-currency management, including real-time exchange rates for accurate financial tracking.

- VAT compliance tools tailored to international tax regulations.

- Collaboration-Friendly:

- Unlimited users ensure teams can collaborate effectively.

- Permission settings allow for secure sharing of sensitive data.

- E-Commerce and Inventory Tools:

- Integrates with 800+ apps, including Shopify and WooCommerce.

- Inventory tracking with real-time stock valuation and reorder alerts.

- Mobile Access:

- Manage invoices, capture receipts, and approve payments on the go with the Xero app.

Pro Tips:

- Utilize Xero’s dashboard to monitor cash flow trends in real time.

- Leverage the payroll add-on to simplify compliance with employee tax regulations.

Pricing:

- Early Plan: $13/month (for startups).

- Growing Plan: $37/month (small businesses).

- Established Plan: $70/month (multi-currency and advanced tools).

Visit Xero’s Official Website for further details.

Detailed Comparison of Features

Pricing Tiers and Flexibility

When choosing accounting software, pricing and flexibility play a critical role, especially for small businesses with tight budgets. Here’s how the top platforms compare:

| Software | Free Plan Available | Entry-Level Pricing | Premium Features Pricing | Scalability Options |

| QuickBooks | No | $30/month | $200+/month (advanced plans) | Offers multiple plans for growing needs |

| Wave | Yes (basic features) | Free | $20+/month (add-ons like payroll) | Affordable add-ons for additional tools |

| Xero | No | $13/month | $70+/month (premium) | Unlimited users and app integrations |

Advanced vs. Basic Features

Different platforms cater to varying business needs. Here’s a breakdown of some advanced versus basic features:

- QuickBooks Advanced: Includes payroll automation, inventory tracking, and advanced analytics for larger businesses.

- Wave Basic: Offers invoicing, expense tracking, and receipt scanning for free—ideal for solo entrepreneurs.

- Xero Premium: Multi-currency capabilities, unlimited users, and extensive third-party integrations.

Each platform offers unique strengths, so choose based on your immediate and future needs.

How to Choose the Right Accounting Software

Assess Your Business Needs

Selecting the right accounting software begins with understanding your business specifics:

- Industry: Retail businesses may need inventory tracking, while service-based companies might prioritize invoicing.

- Size: Solo entrepreneurs often benefit from free or low-cost platforms, whereas larger businesses need scalable solutions.

- Growth Plans: Opt for software that can handle increased complexity as your business expands.

Prioritize Ease of Use and Support

An intuitive interface and reliable customer support are essential for seamless adoption:

- Training: Look for platforms offering tutorials, onboarding guides, and live demos.

- Customer Service: Choose software with 24/7 support through multiple channels like chat, email, and phone.

- Mobile Access: Platforms with mobile apps ensure on-the-go financial management.

Real-Life Examples and Testimonials

Small Business Success Stories

- Wave Transforms a Bakery’s Workflow: A small bakery owner switched to Wave and automated invoicing and expense tracking. This saved them 10 hours a week, which they used to focus on growing their business.

- QuickBooks for a Freelance Consultant: By using QuickBooks’ advanced reporting tools, a freelance consultant improved client billing accuracy, leading to better cash flow and client retention.

- Xero and a Global E-Commerce Store: A startup with international clients utilized Xero’s multi-currency support and integrations with Shopify to streamline operations, boosting sales by 30%.

These real-life examples highlight the tangible benefits of choosing the right accounting software for your specific needs.

Alternatives to Accounting Software

Outsourcing Accounting Services

For small businesses that prefer a hands-off approach, outsourcing accounting tasks can be a viable alternative. By hiring professional accountants or firms, you can:

- Ensure compliance with tax laws and regulations.

- Save time spent on bookkeeping and financial reporting.

- Access expert advice for strategic decision-making.

This option is particularly beneficial for businesses with complex financial needs but may be cost-prohibitive for smaller startups.

Manual Methods Using Excel or Google Sheets

For entrepreneurs who prefer minimal costs, manual tracking with tools like Excel or Google Sheets can be effective:

- Templates: Create templates for income, expenses, and tax calculations.

- Custom Formulas: Use formulas to automate calculations.

- Collaboration: Google Sheets allows real-time updates and sharing.

While cost-effective, manual methods can be time-consuming and prone to errors, making them less ideal as your business grows.

Frequently Asked Questions (FAQs)

“Can accounting software replace an accountant?”

Accounting software simplifies tasks but may not fully replace the strategic advice and expertise of a professional accountant.

“Is free accounting software reliable?”

Yes, many free options like Wave are reliable for basic needs, though they may lack advanced features.

“What’s the best accounting software for freelancers?”

Wave and QuickBooks are great for freelancers due to their ease of use and invoicing tools.

“Does accounting software handle taxes?”

Most software includes tax calculation and filing features, but accuracy depends on user inputs.

“Can I integrate accounting software with my CRM?”

Yes, many platforms, including QuickBooks and Xero, support CRM integrations for seamless data management.

“Is cloud-based accounting secure?”

Reputable platforms use encryption and regular updates to ensure data security.

“Do I need training to use accounting software?”

Most platforms are user-friendly and provide tutorials, but advanced features may require some learning.

“Can I access accounting software on my phone?”

Yes, many platforms like QuickBooks and Xero offer mobile apps for on-the-go access.

“What happens if I stop paying for the software?”

Access to premium features or data may be restricted; always check cancellation policies.

“Is accounting software suitable for international businesses?”

Yes, tools like Xero support multi-currency transactions, making them ideal for global operations.

“Can I customize reports in accounting software?”

Most platforms offer customizable reports to match specific business needs.

“What’s the difference between basic and premium plans?”

Basic plans usually include invoicing and expense tracking, while premium plans add advanced features like payroll and inventory management.

“Are lifetime deals for accounting software worth it?”

Lifetime deals can save money but may have limited features or support compared to subscription models.

“Can I use multiple accounting software together?”

Using multiple tools can lead to data duplication; opt for a single platform with integrations instead.

“How do I migrate data to new accounting software?”

Most platforms offer data import tools or provide support for migration.

Conclusion

Choosing the right accounting software is a critical decision for small business owners. It can streamline finances, save time, and provide insights for growth. With options like QuickBooks for advanced needs, Wave for budget-friendly solutions, and Xero for global operations, there’s something for every business size and type.

Take the time to assess your specific needs, from industry requirements to scalability, and compare features like integrations and ease of use. The right choice will not only simplify bookkeeping but also empower you to make informed business decisions.

Take control of your finances today! Explore the software options we’ve outlined to find the perfect fit for your small business. Ready to get started? Subscribe to our newsletter for more tips and insights, or drop your questions in the comments below!

Hi, I’m Fahim — a SaaS tools reviewer and digital marketing expert with hands-on experience helping businesses grow using the right software. I research, test, and personally use a wide range of AI, business, productivity, marketing, and email tools for my agency, clients, and projects. I create honest, in-depth reviews and guides to help entrepreneurs, freelancers, startups, and digital agencies choose the best tools to save time, boost results, and scale smarter. If I recommend it, I’ve used it — and I only share what truly works.